Finally, it has happened. The reluctant comparisons and bashful voices at the very beginning of the crisis have turned out to be screams and outcries. Almost every newspaper lists the similarities between current global crisis and the Great Depression in 1929. Almost every single news starts with the phrase of “the worst financial crisis since the Great Depression” in order to show us how terrible the situation is.

In fact, it does not seem very likely for this crisis to be a duplication of Great Depression. As The Economist writes “... America’s economy may be just entering recession; between 1929 and 1933 it shrank by more than a quarter. Some economists fear that unemployment, now a touch over 6%, might reach 10%; in 1933 it was about 25%, and many of those in work were on short time and short pay. Americans are not banging at the doors of banks demanding their money, nor queuing around the block for soup and bread.[1]” As a matter of fact, nobody knows exactly what will happen in the future; just, we all want to hope for the recovery.

Another important and somehow mysterious point regarding the crisis is its possible effects on the emerging markets. “How tough this financial turmoil might hit the shores of emerging markets?” has turned out to be one of the most popular questions nowadays. In this regard, as an emerging country, Turkey may be an illuminating case study.

I. Turkish Economy amid Global Financial Turmoil

Turkish economy is very familiar with financial crises and economic fluctuations. Just within two decades, she has experienced four major crises in addition to the minor jolts. However, the 2001 financial crisis was a milestone for Turkish economy in the sense that the GDP shrank by 7.4 per cent in real terms, inflation increased to 68.53 per cent, and the currency lost 51 per cent of its value vis-à-vis other major currencies. The banking sector came very close to the destruction, and many banks went into bankruptcy. “The biggest economic crisis of the Republican era” paved the way for Turkey to re-structure her economy and an ambitious recovery period, which was underpinned by different segments of the society, took off.

In retrospect, it can be said that 2001 financial crisis was almost “home made”. Over the last six years, Turkey has succeeded to transform most of its minuses into plusses, and tried hard to make her home tidy. However, the mortgage crisis in the US in the mid-2007 created new “externalities” for Turkish economy. This time, the nature of the crisis was different because it was not a domestic product, and there occurred a systemic risk on Turkey, like other emerging countries.

II. How Resilient is the Turkish Economy?

Turkish economy has both strengths and weaknesses. In order to see the complete picture one should concentrate on these two dimensions simultaneously. Below, I shall evaluate strengths and weaknesses to create a “balanced” balance sheet.

Strengths:

One of the most important strengths of the Turkish economy is its solid financial system. As I mentioned above, during the recovery period after 2001, Turkish Banking System has improved significantly. The regulatory institutions like Banking Regulation and Supervision Agency (hereafter, BRSA) has become the initiator of the new banking regulations and it promoted the prudential supervision mechanisms. At the end, Turkish Banks positively improved their capital basis, and developed new risk management techniques. As it can be seen from BRSA’s figure below, the CAR, for Turkish Banks is about 17 percent as of 20th of October. This is satisfactorily a high ratio once it is compared with the European banks. In addition, CAR for Turkish Banks is quite above the Basel standards (it is 8 per cent).

More importantly, Turkish banks have almost no open position. The bad memories of 2001 crisis made the Banking managers more cautious against foreign debt and domestic revenue discrepancy.

Second strength of the Turkish economy is the relatively strong position of the CBRT. Now, CBRT holds official FX reserves about 73 billion dollar (as of October 17, 2008). This relatively high volume creates confidence among the market participants, and strengthens the weapons of the CBRT to intervene the currency markets to avoid the excessive volatility.

The third strength of the Turkish economy is the foreign and domestic confidence. Turkey, thanks to the latest diplomatic maneuvers, has become a more visible country not only in Europe but also in the eyes of Middle Eastern investors. The portfolio of Turkish exporters has diversified and Turkish businessmen sign contacts almost all around the world. This situation may create alternative possibilities for Turkish financial markets as well.

Weaknesses:

One of the most important weaknesses of Turkish economy is the open position in the reel sector. According to the Central Bank of the Republic of Turkey, there is an open position amounted to approximately 60 billion dollar, and the reverse movements in the USD/TRY parity may put these firms into payment difficulties. Since these firms have dollar denominated debts and TRY denominated revenues, the appreciation of dollar vis-à-vis TRY may have the potential to create liquidity shortages. If we recognize the liquidity problems all around the developed economies, and take care of the fact that even the banks in the developed countries hesitate while financing each other, it will become obvious that rolling over their debts may somehow be a problematic issue.

The second important issue is the attitudes of Turkish government. At the first stages of the latest wave of the crisis, Turkish government acted as if there would be no such a thing as crisis. However after the USD/TRY parity gained value about 35 per cent within a couple of weeks, the first steps of policy measures announced by the government. The “overvalued” Turkish lira was an important concern for the Turkish exporters; however, even they criticized the immediate jump of the parity. The public pressure from business environments forced the government to think on new measures. As a result, the Ministry of Finance started to work on some tax relief proposals in order to alleviate the burden on the producers. The CBRT, also, started to provide 50 million amounted dollars daily in order to avoid the excess volatility in exchange rates. In the following days, Turkish government may announce new measures to improve the conditions of SMEs’ accessibility to credit markets.

The third important issue is about the future of the Turkish economy in general. In this regard, two major problems seem to come to the forefront:

1. Current Account Problem

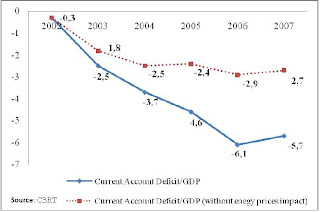

Current account deficit has always been one of the headaches of Turkish economy. Especially after 2001 period, the current account deficit/GDP ratio increased steadily and reached to 5.7 per cent at the end of 2007. Financing this relatively high ratio was sustained by intense privatization applications and portfolio inflows. Since there is a retreat in global liquidity, it may become a problematic issue to create new sources. However, it is of vital importance not to overlook one point here. Since Turkey is an oil importer country, the ascendance in oil prices has contributed significantly to the current account deficit. As known, given that the oil prices turned direction into negative; it becomes apt for us to expect a decrease in the CAD/GDP ratio. In order to understand “energy effect”, it is possible to draw the following figure. In the following figure, the dashed line shows the current account deficit/ GDP ratio if the energy prices are kept constant at 2002 prices[2]. The other line shows the same ratio with taking the current energy prices into consideration. If the decrease in oil prices continues, the CAD pressure on Turkish economy seems to alleviate.

2. Trade Problem

Another important point for the Turkish economy over the next months may be the slowdown in export growth rates. Since Turkey is a country that sells mostly to the Western markets, a possible leftwards shift of the demand curve in the European markets due to the financial crisis, may affect Turkish exporters negatively. According to the latest trade statistics, almost half of Turkey’s exports are directed towards the European Union countries. Given that the EU is on the brink of recession and it is hard to be optimistic about the future, the concerns have a ground. However, there are also attempts to diversify the trade structure in Turkey. Irrefutable achievements also materialized already. For example, Turkey’s five biggest markets now take 37 per cent of exports, down from 50 per cent in 2002[3].

III. Positives and Negatives: Which one surpasses?

As I tried to demonstrate Turkish economy has both strengths and weaknesses. Yet, in the final analysis, which one surpasses? Actually, the correct answer should be “it depends!” The final balance will ultimately depend on international and domestic factors.

The international side of the story is very dependent on the next phases of the crisis. If the fluctuations and bank failures continue in the Western markets, and if these economies plunged into a long lasting recession as some argue, Turkey will be affected inescapably. As a matter of fact, the emerging markets as well as Turkey have not too many instruments to reverse this situation.

The domestic side of the story is much more important for Turkey. If the government recognizes the gravity of the situation and succeeds to create a solid political base albeit the fractious nature of Turkish politics, there are still enough rooms for Turkey to escape from the external waves at least to some extent. Moreover, if it becomes possible to reach at a compromise with the IMF and to accelerate the negotiations with the EU[4], Turkey may consolidate the confidence of the foreign investors as well as domestic actors. With the help of these two “external anchors”, it is possible for Turkish economy to turn the crisis into a kind of chance.

References

[1] The Economist, “Echoes of the Depression: 1929 and all That”, October 4th-10th 2008, p.76

[2] This figure is drawn according to the calculations of the CBRT. See: “Financial Stability Report”, May 2008, Volume: 6, p.8. Accessable at http://www.tcmb.gov.tr/

[3] The Economist, “Turkey’s Economy: In need of an Anchor”, October 25th-31th 2008, p. 38.

[4] The anchor role of the EU seems to be more efficient than the IMF if one takes care of the latest developments. Hence, the improvement of the Turkish-EU relations would be more beneficial for Turkey. Simultaneously, Turkey should not deny sitting on the table with the IMF. Since Turkish economy is stronger than the past, Turkey may have a chance to reach at a consensus with the IMF under much better conditions than the previous one.

[2] This figure is drawn according to the calculations of the CBRT. See: “Financial Stability Report”, May 2008, Volume: 6, p.8. Accessable at http://www.tcmb.gov.tr/

[3] The Economist, “Turkey’s Economy: In need of an Anchor”, October 25th-31th 2008, p. 38.

[4] The anchor role of the EU seems to be more efficient than the IMF if one takes care of the latest developments. Hence, the improvement of the Turkish-EU relations would be more beneficial for Turkey. Simultaneously, Turkey should not deny sitting on the table with the IMF. Since Turkish economy is stronger than the past, Turkey may have a chance to reach at a consensus with the IMF under much better conditions than the previous one.

Mustafa Kutlay

mkutlay@usak.org.trUSAK EU Studies Desk,

22.23

22.23

putut joko utomo

putut joko utomo

Posted in:

Posted in:

0 komentar:

Posting Komentar